Bangladeshi Payment Methods for Online Transactions

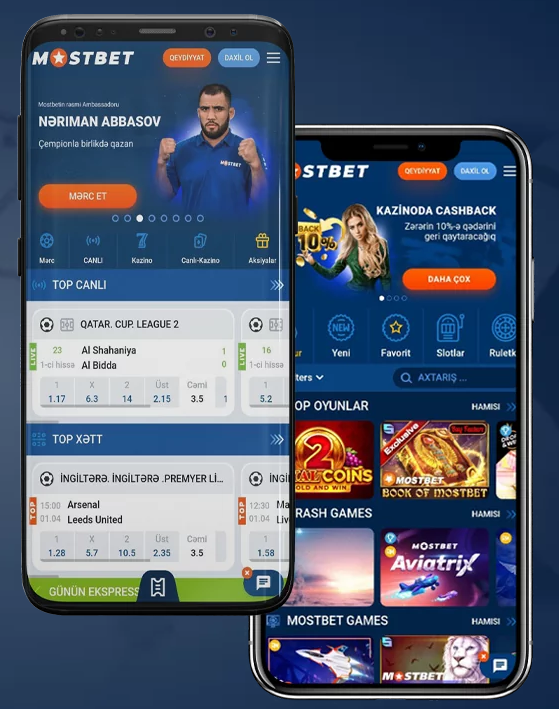

In the era of digital transformation, Bangladesh is rapidly adopting various online payment methods that ensure convenience and security for users. From traditional bank transfers to advanced digital wallets, the landscape of online payments is evolving swiftly. In this article, we delve into the popular Bangladeshi payment methods and what makes them suitable for online transactions, enhancing the user experience in a growing digital economy. For those looking for financial platforms, the Bangladeshi Payment Methods for Online Casino Transactions Mostbet app is gaining attention for its seamless functionalities.

1. Traditional Bank Transfers

Bank transfers remain one of the foundational methods for conducting online transactions in Bangladesh. Most banks offer online banking services that allow users to transfer funds easily between accounts. This method has been enhanced with the introduction of electronic fund transfer systems, which allow for real-time transactions.

Additionally, services such as RTGS (Real-Time Gross Settlement) and BACS (Bankers’ Automated Clearing Services) are improving the efficiency of bank transfers. However, while these methods are secure, they can be relatively slower compared to newer digital alternatives, with processing times that might take several hours or even days for certain transactions.

2. Mobile Payment Solutions

With the substantial increase in mobile phone usage in Bangladesh, mobile payment solutions have gained immense popularity. Services like bKash and Rocket lead the market by providing users with the ability to conduct transactions through their mobile devices quickly.

bKash is one of the most used mobile financial services in Bangladesh. It allows users to send and receive money, pay bills, and make purchases online. Its user-friendly interface and extensive agent network make it accessible to both urban and rural populations. Similarly, Rocket, operated by Dutch-Bangla Bank, offers instant mobile banking solutions and is favored for its cashback features on certain transactions.

3. Digital Wallets

In recent years, digital wallets have emerged as a robust alternative for online payments. These platforms store users’ payment information securely and facilitate easy transactions without needing direct bank involvement for each purchase.

Prominent digital wallets in Bangladesh include Payoneer and Payza, which offer international transaction capabilities. They are especially popular among freelancers and individuals engaged in e-commerce. The ease of transferring funds across borders and converting currencies has made these wallets appealing for online entrepreneurs.

4. E-commerce Platforms and Gateways

As e-commerce continues to flourish in Bangladesh, the demand for efficient payment gateways has increased. Payment gateway services like SSLCommerz and Razorpay facilitate smooth transactions for online businesses and provide support for multiple payment methods, including credit and debit cards, mobile wallets, and bank transfers.

These platforms prioritize security and customer support, addressing potential concerns regarding online fraud and ensuring that transactions are encrypted. Moreover, the ability to process payments in local currency significantly enhances the user’s confidence in electronic commerce.

5. Credit and Debit Cards

While credit and debit cards are prevalent globally, their adoption in Bangladesh is gradually increasing. Local banks issue cards that can be used for both domestic and international transactions.

However, the acceptance of cards for online payments can vary. Certain online merchants may not support card payments directly, thus requiring users to resort to other methods such as mobile payments or digital wallets. Payment systems like Visa and Mastercard are working on expanding their network and improving card acceptance for online transactions.

6. Cryptocurrency

Though still in its infancy, the use of cryptocurrency as a payment method is slowly gaining traction in Bangladesh. With global trends pushing towards a decentralized economy, more Bangladeshis are exploring digital currencies like Bitcoin for online transactions.

However, the regulatory framework surrounding cryptocurrencies remains uncertain, with the Bangladeshi government taking a cautious approach toward its use. As the situation evolves, it will be interesting to see how cryptocurrencies integrate into the wider banking system and whether they will become a standard method for online payments in the country.

7. The Future of Payment Methods in Bangladesh

The future of online payment methods in Bangladesh looks promising, with a mix of traditional banking and innovative digital solutions leading the way. The government’s push towards financial inclusion and the promotion of cashless transactions are pivotal in ensuring that all citizens have access to modern payment systems, regardless of their socio-economic status.

Moreover, with the growing tech-savvy population, the demand for secure, fast, and efficient payment solutions will continue to increase. As more businesses and consumers embrace digital payments, we can expect a further evolution of payment methods, combining convenience with security to suit Bangladesh’s unique market dynamics.

Conclusion

Bangladesh is on the cusp of a digital payments revolution, with increasing adaptation of diverse payment methods capable of catering to various consumer needs. From traditional banking methods to modern digital wallets and payment gateways, each option offers unique advantages. As technology continues to advance, the landscape will undoubtedly change, providing more innovative solutions to enhance the online transaction experience.