Decide your corporation use proportion and apply this to your annual internet prices. It’s necessary to notice that when you use your car for each business and private functions, you’ll have the ability to solely claim the business portion. Commuting miles between your house and regular office are usually not deductible. Jeremy A. Johnson is a Fort Worth CPA who combines strategic tax planning, accounting, CFO providers, and business advisory services into a single, end-to-end solution for growth-stage companies.

Deductions Primarily Based On Predetermined Charges

These contributions not only help secure your monetary future but additionally provide useful tax advantages within the present. Consulting with a monetary advisor or tax skilled ensures you’re making essentially the most of your retirement financial savings opportunities whereas staying compliant with tax rules. Consulting with a tax skilled is extremely beneficial to know the precise requirements and guidelines related to utilizing various forms of proof for deductions.

Personal Property & Automobile Deductions

Additionally, don’t forget vitality tax credit for things like wind and solar installations. There are a number of different receipts that you can be wish to save, relying in your private tax situation. For some, it is useful to deduct your state and local sales tax in your itemized deductions, rather than the amount of state and native income taxes you paid through the yr. Armed with the proper information about receipt-free deductions, handling tax submitting becomes more manageable. If you’re not sure what receipts you have to prepare your tax return, think about seeking the assistance of a tax professional. They might help you consider your tax state of affairs and establish the kinds of deductions you’re entitled to take, and advise you as to what receipts you’ll must doc expenses.

Donations At Religious Companies

Self-employed people often bear the total cost of their health insurance premiums, however these expenses could be deductible with out the necessity for receipts in plenty of instances. Let’s discover what you have to find out about claiming medical insurance premiums as a self-employed particular person. Self-employed people often have unique opportunities for tax deductions, and some may be claimed with out receipts. Understanding these deductions can significantly reduce your tax liability and assist you to hold more of your hard-earned cash. As you think about your tax strategy, keep the usual deduction in thoughts as a robust software for maximizing your tax savings with minimal effort. Keep In Mind that whereas the standard deduction is simple, consulting with a tax skilled can help ensure you’re making the finest choice on your specific financial situation.

The key to success lies in dedication to a system that makes it more like a day by day behavior than a chore. Don’t forget to save lots of your receipts for business purchases, that are stuff you purchase and resell to customers https://www.kelleysbookkeeping.com/. A query we’re usually asked is whether or not or not digital receipts are acceptable to the IRS. The IRS has accepted each scanned and digital receipts as valid data since 1997.

These who qualify can deduct issues like desks, residence repairs, office supplies and portions of their mortgage interest and utilities, she added. Homeowners and renters each qualify, and beneath IRS rules, a “house” could be a house, an apartment, condo, cellular residence, boat, unattached garage, studio, barn or greenhouse. Each conventional braces and Invisalign could be tax deductible if they are prescribed by a certified dental skilled to deal with a reliable dental condition. If they are purely for beauty reasons, nevertheless, they are typically not deductible. If you have a health savings account (HSA), both through work or on your own — like Vigorous or Health Equity — you can what receipts can i claim on my taxes‘t itemize bills paid out of that account.

Any fees you paid to an expert like an lawyer or accountant could be deducted on your tax return if they’re related to your small business. If you began your business this 12 months, you’ll find a way to deduct up to $5,000 in enterprise start-up expenses and one other $5,000 in organizational bills for that first 12 months. Your business tax guidelines should embody a listing of all the business expense deductions you’re eligible for. Depending on the expense, you could possibly partially deduct that value or write off the expense in its entirety. Throughout an audit, the IRS prefers to see receipts or different documentation to assist deductions however recognizes that receipts aren’t all the time available or required for each deduction. If you’ve claimed deductions without receipts, be prepared to elucidate how you calculate the deduction and supply any supporting documentation you do have.

- While sustaining receipts is usually the preferred technique for substantiating deductions, there are particular deductions that can be claimed with out receipts.

- When making ready their annual earnings tax returns, filers might take a Commonplace Deduction or itemize their bills.

- To claim a refundable tax credit score, however, a taxpayer generally has to file a tax return and then receive the tax credit at refund time.

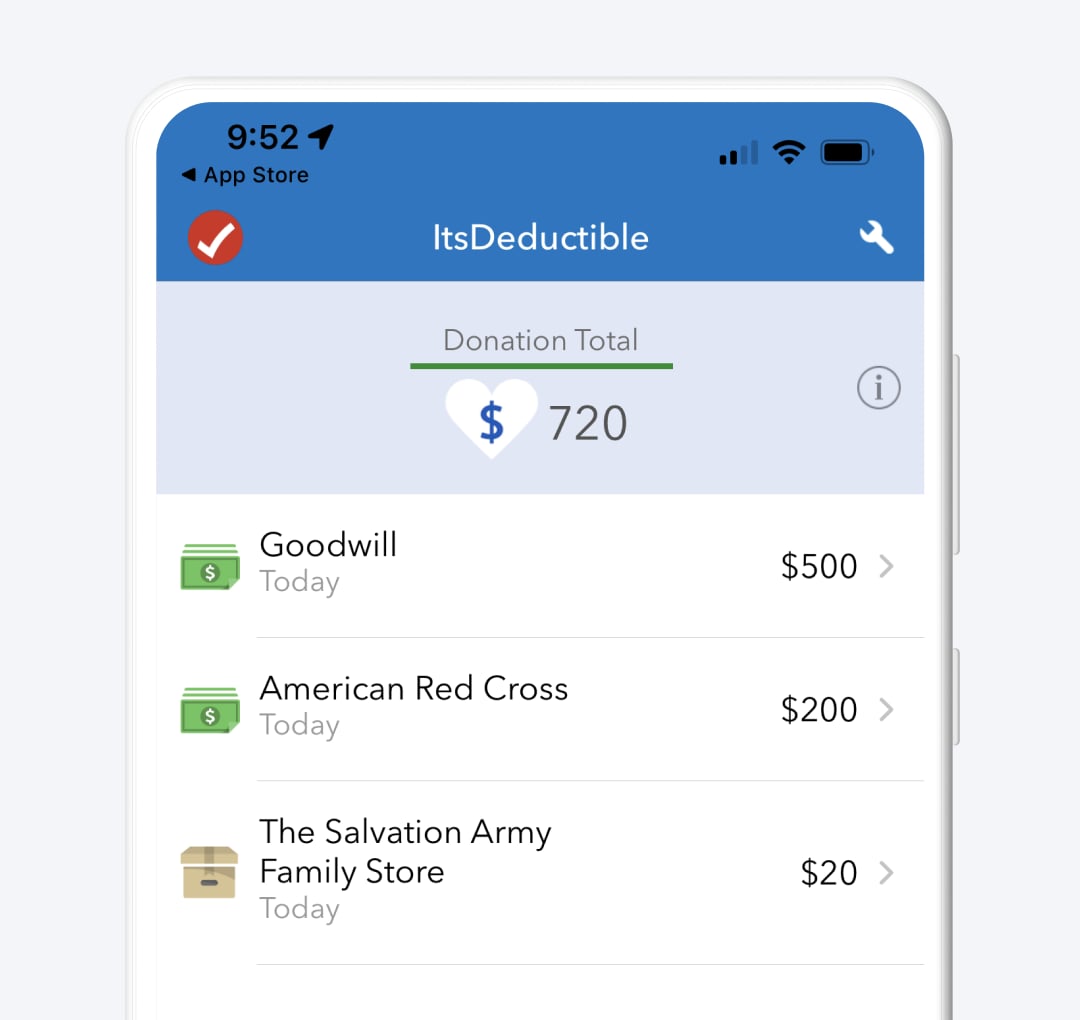

- The IRS values each donation individually so you can also make separate $250 donations with out receipts.

- The key’s knowing the way to save receipts and file them in an orderly style.

It’s necessary to distinguish between deductible and non-deductible bills to verify your tax return is accurate. To help your charitable deductions, create a simple spreadsheet to trace all donations. Take pictures of donated items for non-cash contributions and save email confirmations from on-line donations. Charitable giving benefits worthy causes and can present tax advantages. Even small donations made with out keeping receipts should be eligible for deductions.

Or get unlimited assist and advice from tax experts when you do your taxes with TurboTax Live Assisted. And if you need to file your own taxes, TurboTax will guide you step by step so you’ll find a way to feel confident they’re going to be carried out proper. No matter which method you file, we guarantee one hundred pc accuracy and your maximum refund.Get started now by logging into TurboTax and file with confidence. Beginning with the 2018 tax yr, unreimbursed worker bills are no longer deductible for federal taxes. Ellen Chang is a freelance journalist who is based in Houston and writes articles for U.S. Chang previously coated investing, retirement and private finance for TheStreet.

Create a written report detailing the expense, including the quantity, date, function, and enterprise relationship. Retirement plan contributions supply potential tax deductions with out traditional receipts while securing your financial future. These contributions can provide significant tax advantages, making them an essential aspect of monetary planning. Whereas the usual deduction is a wonderful possibility for many taxpayers, it’s value contemplating whether itemizing your deductions might lead to a larger tax profit. Itemized deductions embody expenses like mortgage interest, charitable donations, and state and local taxes.